All Articles

|

Dear friends and customers: On behalf of Consumer Safety Officer/Investigator Max Leimgruber, please be advised that the Calexico FDA office will have an Informative Broker Meeting at the Calexico City Council Chambers on June 12, 2024 from 10:00 am – 12:00 pm.

This meeting will be to update the Brokers Community in regard to the FDA-Calexico operation. However, everyone is welcome to attend, including customers. Please feel free to contact us if you have any questions or comments to MAX.LEIMGRUBER@FDA.HHS.GOV. Sincerely, RL Jones |

|

Dear friends and customers:

On behalf of Assistant Port Director Bonnie Arellano, attached is the Port Information Notice for the current Calexico Port of Enty commercial facility northbound and southbound lane segmentation.

Please feel free to contact us if you have any questions or comments.

Sincerely, RL Jones |

The U.S. Department of Commerce preliminarily determined that antidumping duties (ADD) will be applied to imports of aluminum extrusions from China, Colombia, Ecuador, India, Indonesia, Italy, Korea, Malaysia, Mexico, Taiwan, Thailand, Turkey, United Arab Emirates, and Vietnam. The corresponding preliminary notices can be found at https://access.trade.gov . Please note that there were four previously reported Countervailing Duty (CVD) preliminary determinations published for China, Indonesia, Mexico, and Turkey.

Suspension of Liquidation: U.S. Customs and Border Protection (CBP) will suspend liquidation of entries of subject merchandise as described in the scope of the investigation entered, or withdrawn from warehouse, for consumption on or after May 7, 2024. CBP will require a cash deposit rates depending on the country, manufacturer, and exporter. The following ad valorem rates apply. Please refer to the Trade.gov website indicated above for specific rates by manufacture and exporter.

Country Case Number Cash Deposit Rate Cash Deposit All Others Rate

China A-570-158 0.00 – 365.19

Colombia A-301-806 8.85 – 34.47% 12.42

Ecuador A-331-804 17.23 – 51.20 % 22.52

India A-533-920 3.44 - 39.05 3.44

Indonesia A-560-840 5.65- 112.21 9.17

Italy A-475-846 0.00 – 41.67 15.30

Korea, S A-580-918 0.00 – 43.56 2.42

Malaysia A-557-826 0.00 – 27.51 26.70

Mexico A-201-860 9.18 – 82.03 13.63

Taiwan A-583-874 0.73 – 67.86 33.93

Thailand A-549-847 2.02 – 4.04 3.03

Turkey A-489-850 45.41- 594.55 73.23

UAE A-520-810 9.13 – 42.29 9.15

Vietnam A-552-837 2.85 41.38

U.S. International Trade Commission Notification: If the final determination is affirmative, the ITC will determine before the later of 120 days after the date of the preliminary determination or 45 days after the final determination whether imports of aluminum extrusions from these countries are materially injuring, or threaten material injury to, the U.S. industry. If affirmative, the case will go to order and remain in force.

Scope: The merchandise subject to this investigation are aluminum extrusions, regardless of form, finishing, or fabrication, whether assembled with other parts or unassembled, whether coated, painted, anodized, or thermally improved. Aluminum extrusions are shapes and forms, produced by an extrusion process, made from aluminum alloys having metallic elements corresponding to the alloy series designations published by the Aluminum Association commencing with the numbers 1, 3, and 6 (or proprietary equivalents or other certifying body equivalents).

The country of origin of the aluminum extrusion is determined by where the metal is extruded (i.e., pressed through a die). Aluminum extrusions that are drawn subsequent to extrusion (drawn aluminum) are also included in the scope.

Merchandise that is comprised solely of aluminum extrusions or aluminum extrusions and

fasteners, whether assembled at the time of importation or unassembled, is covered by the scope in its

entirety. The scope also includes aluminum extrusions contained in merchandise that is a part or subassembly of a larger whole, whether or not the merchandise also contains a component other than aluminum extrusions that is beyond a fastener.

The scope excludes aluminum extrusions contained in fully and permanently assembled merchandise, or unassembled, if it is not a part or subassembly of a larger whole. To be excluded under this paragraph, the assembled or unassembled merchandise must also contain a component other than aluminum extrusions, beyond fasteners.

For further information regarding the scope, please see the attached Appendix I, and the Trade.gov website indicated above. Commerce will make its final determination no later than 135 days after the date of publication of the preliminary determination.

|

Information Bulletin |

|

Dear friends and customers: As part of our Supply Chain Security Customer Education Program, attached please find our second quarterly C-TPAT notice for 2024. This edition relates to “Cybersecurity Incident Reporting”. Please feel free to contact us if you have any questions or comments. Sincerely, R.L. Jones Customhouse Brokers |

Dear friends and customers:

As part of our Supply Chain Security Customer Education Program, attached please find our first quarterly C-TPAT notice for 2024. This edition relates to “Employee and Visitor ID Controls”.

Please feel free to contact us if you have any questions or comments.

Sincerely,

Best wishes to all of you, for a healthy and successful 2024. Thank you very much for your support. We look forward to our continued partnership in our new building.

Merry Christmas,

Eduardo “Lalo” Acosta

RL Jones

Good day everyone,

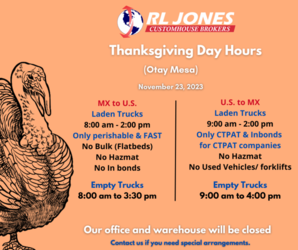

Please see below our hours of operation for next week’s Thanksgiving Holiday.

Please note that our office will be open to provide entry and export services, but our warehouses will be closed. Feel free to contact our teams in you need services that day.

Happy Wednesday to all.

Eduardo "Lalo" Acosta

Please see attached hours of operation for Mexican Customs’ holiday on Monday, Nov. 20th, in observance of the Mexican Revolution.

Note that the hours for Northbound shipments was extended to 6 am to 5 pm (normal holiday hours are 8 am - 2 pm). These hours are for all cargo, except Haz Mat. Also note that southbound hours will be 8 am – 4 pm.

Please talk to your Mexican broker to ensure they will service these new hours.

Our office and warehouses will be open normal hours.

Have a great day.

Eduardo "Lalo" Acosta

Peter Friedmann, FBB Federal Relations and Legal Counsel for the Pacific Coast Council, a regional association of customs brokers throughout the west.

Known as "Our Man in DC,” Peter Friedmann is a DC insider who will address the most pressing issues our trade community is facing, including China tariffs, changing US-Mexico trade tensions and regulation, maquiladora access to US market, new north-south rail connections, cross-border trucking, personnel shortages at CBP. What’s on your mind? Peter loves your questions.

Tuesday October 24

San Diego Country Club

88 L Street, Chula Vista, CA 91911

6:00 p.m. to 9:00p.m.

Dinner and Program

SDCBA Members: $85 per person non-members: $100 per person

Advanced payment required- no walk ins allowed

Good afternoon, I hope you are all having a great day. Below are Customs and Border Protection’s (CBP) hours of operation for Labor Day 2023, which will be observed on Monday, September 4th, 2023. Please plan accordingly. Our office and warehouse will be closed. If you need special arrangements, please contact our staff.

Sincerely,

Good afternoon. Here is some important information regarding Container and Trailer security. We can never be too careful.

Have a great week.

Sincerely,

Eduardo "Lalo" Acosta

Trade Participants,

CBP Otay Mesa has been notified by MX ANAM that as of 1040 am, all commercial processing automated systems are fully operational, for processing both inbound and outbound commercial traffic. Otay Mesa Commercial Operations are operating with all available northbound and southbound lanes

Trade Participants,

CBP Otay Mesa has been notified by MX ANAM concerning the outage experienced this morning. They are experiencing a loss of Internet connectivity. The problem is being worked, but at present, there is no eta for their systems to come back up.

With no Internet, there is no contingency for processing laden commercial traffic at this time.

Otay Mesa Commercial Operations are operating with all available northbound and southbound lanes. Commercial operations at Tecate POE are not impacted by this outage.

Any further information we receive, we will share, as needed.

And as always, please feel free to share this information with any interested parties.

Regards,

Good day to everyone. I just wanted to give you an update on our new building and moving date. Everything is going according to plan, and we are keeping our fingers crossed that things stay on course.

Please see attachment for details.

Have a great day.

Eduardo "Lalo" Acosta

R.L. Jones San Diego

8830 Siempre Viva Rd. #100

San Diego, CA 92154

(619)661-8182 ext 1100

(619)661-8181 Fax

Good morning and happy Monday to everyone.

Please note that Customs and Border Protection will observe Independence Day on Tuesday, July 4th, with the following hours of operation:

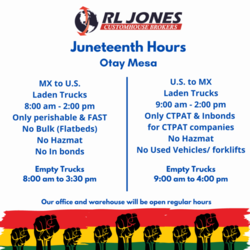

Good morning and happy Monday to everyone.

Please note that Customs and Border Protection will observe Juneteenth ( Monday June 19, 2023) , with the following hours of operation:

Sincerely,

|

|

Good afternoon and Happy Tuesday to everyone.

Please note that Customs and Border Protection will observe Memorial Day Monday, May 29, 2023, with the following hours of operation:

For Monday’s holiday, hours will be:

Northbound 8-2 pm FAST and Perishable entries only.

Southbound 9-2 pm CTPAT certified exports only.

Our office and warehouse will be closed. Please contact us if you need special arrangements.

Have a great day.

Eduardo "Lalo" Acosta

R.L. Jones San Diego

8830 Siempre Viva Rd. #100

San Diego, CA 92154

(619)661-8182 ext 1100

(619)661-8181 Fax

Dear friends and customers,

The following is to inform you about the upcoming "Memorial Day" holiday schedule observed Monday, May 29, 2023. U.S. Customs will be open for business and will follow the holidays schedule from 6:00 a.m. to 4:00 p.m.

|

Calexico-Mexicali: |

|

|

8:00 a.m. to 2:00 p.m. |

Laden trucks |

|

8:00 a.m. to 1:30 p.m. |

In bond shipments |

|

8:00 a.m. to 3:00 p.m. |

Empty trucks |

|

8:00 a.m. to 12:00 p.m. |

Vehicle exportation (self-propelled only) |

|

Mexicali - Calexico: |

|

|

6:00 a.m. to 3:00 p.m. |

All empty and laden trucks |

|

6:00 a.m. to 3:00 p.m. |

Bulk merchandise (non-Hazmat) and scrap material. |

|

3:00 p.m. to 4:00 p.m. |

Primary gates will be closed; however, the cargo offices will remain open to finish processing entries and field inquires from trade. |

As usual, please keep in mind that the below listed commodities will not be allowed entry on this day:

- Textiles (Northbound/ MX-US)

-Hazardous Materials

- Commodities requiring visa or special permits

|

RL Jones Calexico Office |

8:00 a.m. to 2:00 p.m. (Export staff available only) (Limited personal) |

|

RL Jones Calexico Warehouse |

CLOSED (Overtime schedule only) Please call in advance for overtime service requirement |

|

Servicios Jones Office |

8:00 a.m. to 5:00 p.m. |

|

Freight Office |

8:00 a.m. to 3:00 p.m. |

For more details, please refer to the attached PIN from CBP.

If you have any questions, please feel free to contact our offices.

Sincerely,

Good morning and happy Monday to everyone

Please note that Customs and Border Protection will observe Memorial Day ( Monday May 29, 2023) , with the following hours of operation:

Regards

Latest News

Border Wait Times